- Home

- Meet the Team

- Log In

- Contact

- Careers

- Search

- Search Results

- Branches & ATMs

- Rates

- Log In

- About MCU

- Join MCU

- Personal Banking

- Lending

- Credit Cards

- Lending Services

- Insurance

- Member Resources

- MCU Financials

- Forms and Disclosures

- Privacy Policy

- Automated Telephone Banking

- Order New Checks

- Security & Fraud Alerts

- Privacy Notice

- Schedule an Appointment

Frequently Asked Questions

Got questions? We’ve got answers.

Account Services

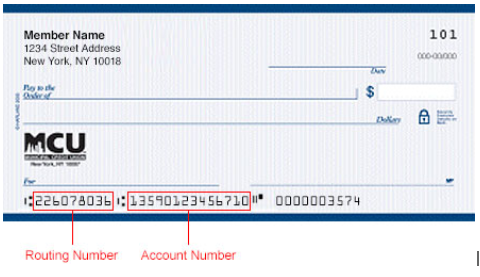

Where can I find my Routing and Account Number?

Both are listed on the bottom of your MCU personal checks. Please see the diagram below for reference:

Can I get my payments taken out of my payroll?

ATMs & Branches

Can we have an ATM at our location?

Where are your branch locations/ATM locations?

You can search for MCU Branch and ATM locations here.

Where can I find MCU branches and fee-free ATMs?

How do I find a free ATM to use?

Auto Loans & Services

How do I apply for an auto loan?

What is Accident Forgiveness?

Why does pre-approval matter?

What is GAP coverage?

covered by the borrower's primary insurance carrier settlement in the event of a total loss or unrecovered theft, subject to

limitations and exclusions, including but not limited to loan-to-value (LTV) maximum, delinquent payments, late charges,

refundable service warranty contracts and other insurance related charges.

GAP covers the difference between the borrower’s outstanding loan balance and the actual cash value (ACV) of the vehicle up to the maximum LTV%.

How does the MCU Car Buying Service work?

What is a prepayment fee?

Is there a fee for using the MCU Car Buying Service?

How does auto refinancing work?

What is Better Car Replacement?

What is MSRP?

Will refinancing transfer ownership of my car to someone else?

Careers

I don’t see an open position that’s right for me. Can I still apply?

Yes! We are always building our list of talented potential team members. Please feel free to send us your resume by:

Email: hrrecruitment@nymcu.org

Mail:

MCU Human Resources Department

Municipal Credit Union

22 Cortlandt Street

New York, NY 10007

How will I know if my application is being reviewed?

I am disabled but would love to work for MCU. What kind of accommodations do you offer at your bank for team members?

We’re excited to learn about your interest in joining the team! At MCU, we’re committed to providing equal employment opportunities for everyone, regardless of disability. Here are a few of the accommodations we provide to make that possible:

- Improved accessibility to navigate the work area

- Services to increase access to work materials

- Changing or reassigning job tasks to accommodate needs

- Reserved accessible parking spaces

How long does it take to hear back about my job application?

Checking & Savings

Can I be sure that my deposits are safe?

What’s the difference between "available balance" and "total balance"?

Are my savings insured?

Is there a monthly fee on savings products?

Can I use my MCU debit card anywhere?

Is there a maximum amount of transactions I can make with my Everyday Hero Checking Account?

How do I know which savings product is best suited for my needs?

What happens if I need the money in my Share Certificate Account before the term is up?

Can I extend my Share Certificate term for another investment once my term is up?

Club Accounts

Can I open my account at any time of the year?

Can I access my money early without penalty?

What is the schedule of when dividends are paid?

General

What makes MCU different from a "'normal" bank?

Are my deposits insured?

Why do credit unions have members?

Am I eligible to become an MCU member?

Getting in Touch

How do we contact you to set up a site visit?

Who can I contact if I have questions about my account?

Hours: Monday - Friday: 7:00am -7:00pm

Saturday: 9am - 2pm

Sunday: Closed

1-844-MCU-NYNY (1-844-628-6969)

Partnering with MCU

What is Human Resources’ role in a partnership with MCU?

How long does it take until the employee's account is opened?

When will employees have their direct deposits set up?

Do our employees need cash to open their accounts?

How do we contact you if we have questions about partnering with MCU?

Can our employees take MCU into retirement?

Home Loans

Do I need to get a home appraisal?

Do I need to get pre-approved before buying a home?

While mortgage pre-approval is not required to make an offer on a house, getting pre-approved is highly recommended if you are planning to buy.

Pre-approval gives you a better idea of the loan amount you can get, the fees associated with it, and allows you to better budget for your future home.

In addition, sellers and realtors will be much more likely to accept an offer from someone with pre-approval.

Is there a cap on how much I can borrow with a conventional loan?

Do Jumbo Mortgages need to be a 30-year fixed rate loan?

Is there someone that can help me with questions I have?

How do I know if I qualify for a High-Balance Mortgage?

Which is better, a fixed-rate or an adjustable-rate mortgage?

Is a Home Equity Loan’s interest rate fixed or variable?

What’s the difference between a home equity loan or a home equity line of credit?

What happens if I don’t use the full value of my home equity line of credit?

Am I able to refinance my mortgage in the future?

Usually, yes.

However, there are criteria you must meet to refinance your home, depending on the type of mortgage you have and the type of refinance you want.

For most types of mortgages, you’ll need to have:

- Owned and occupied the house for at least 7 months

- Had a mortgage on the house for at least 7 months

- No late mortgage payments in the last 6 months

- 1 or fewer late mortgage payments in the past 12 months

For conventional mortgages, often you can refinances as soon as you’d like as long as you use a different lender.

If you need specific advice on refinancing your own mortgage, talk to one of our MCU Lending Sales Specialists.

What’s the difference between a conforming and nonconforming loan?

A conforming loan is determined by guidelines set by agencies like Fannie Mae and Freddie Mac, which are backed by the federal government.

Conforming loans tend to have lower interest rates because there is a larger secondary market for them, which means you'll have lower monthly payments and spend less total over the life of the loan.

Conforming loans are highly standardized, since they must meet federal requirements. While it's always good to take time to consider any financial decision, federal requirements limit the likelihood that you'll be subject to unusual lender conditions.

Conforming loans are more likely to have protections backed by the federal government built in for when you face setbacks, such as an economic recession.

Conforming loans are more difficult to obtain for borrowers with low incomes, no or low credit scores, and higher debt-to-income (DTI) ratios.

A nonconforming loan is literally any mortgage loan that doesn't meet the requirements for a conforming loan—should've known! This doesn't mean they're less advantageous; for example, commercial properties are often financed with nonconforming loans.

Nonconforming loans tend to have more variety, which means you might get more flexibility since you may not be held to the stringent requirements of conforming loans. For instance, you might be able to afford to buy in a more expensive area or buy a type of home that isn't eligible for a conforming loan.

Nonconforming loans are inherently available to more borrowers, and some lenders even offer nonconforming loans specifically as solutions for a borrower with no or low credit, low household income, or even a past bankruptcy.

Since these loans are more accessible, they are also more expensive. Any lender will tend to charge more for borrowers that pose a higher risk, so you'll pay a higher down payment, higher interest rates, and potentially higher fees.

Though a conforming loan is often the first choice, nonconforming loans can offer flexibility and increase the likelihood of your loan application being accepted.

How can I get a better mortgage rate?

There are a lot of factors that go into determining mortgage rates. Most of these factors are outside of your control—for example, overall economic growth and the interest rates set by the Federal Reserve.

However, there are things you can do to ensure you’re getting the best rate you can on your mortgage:

- Focus on your credit score

- The higher your credit score, the more likely you’ll qualify for a lower mortgage rate.

- Save up for your down payment

- More money down will shrink your loan-to-value ratio, meaning you’ll likely qualify for better rates on a smaller mortgage.

- Find the type of mortgage that’s right for you

- Our MCU Lending Sales Specialists are always here to help.

- If you are a first-time home buyer, there may be programs to help make your mortgage more affordable. MCU can help with those too!.

How do I set up my monthly mortgage payment?

There are a few ways to set up your mortgage payments:

- Set up automatic payments through the MCU website or app

- Make a payment by visiting your MCU branch

- Send a check by mail each month

What type of documentation do I need for a conventional loan?

When you’re ready to apply for a conventional loan, it’s a good idea to have these documents ready to go:

- Tax returns

- Pay stubs, W-2s or other proof of income

- Bank statements and other assets

- Credit history report

- Gift letters

- Photo ID

- Renting history

- Debt history

Can I only buy certain types of homes with a conventional loan?

What is the primary benefit of conventional loans?

How much of the down payment do I need for a conventional loan?

Do Jumbo Mortgages have affordable interest rates?

What is the limit of the loan?

Is it hard to qualify for Jumbo Mortgage?

What is the limit of a High-Balance Mortgage?

Do I need a 30-month term to have a High-Balance Mortgage?

How will a mortgage affect my credit score?

Getting a mortgage can be a benefit to your credit score in the long term!

Your credit score might dip when you initially take out your mortgage, but mortgages can improve your ‘credit mix’ and add to your credit history. Both of these will improve your credit score over time—something you likely won’t get when paying rent or a lease.

What happens if I want to move before I finish paying off my loan?

If you move before paying off your loan entirely, you are responsible for paying the loan in full at the time of the sale of your property.

What percent down do I need for an Investment Property Loan?

What’s the difference between a fixed-rate mortgage and an adjustable-rate mortgage?

Is there a maximum on how much my rate can increase?

I’m not planning on staying in my home for long, is an Adjustable Rate Mortgage right for me?

Is it better to have a short or long term mortgage plan?

The answer to this question is entirely dependent on your financial situation. When thinking long-term, it is apparent that you will save more on the interest incurred over a shorter, 15-year mortgage than you would with a 30-year one. However, your payment for a 15-year mortgage will typically be higher and therefore depends on your ability to pay an increased monthly mortgage.

What is the limit I can borrow?

Your borrowing limit will be determined based on a mix of factors, such as your yearly income, the term length of your mortgage, and the mortgage interest rate.

Use our mortgage calculator to get an estimate of the investment mortgage you may be able to qualify for.

What can I use a home equity loan to pay for?

What are the different interest rates on an Investment Property Loan?

Insurance

What is the process for applying for insurance through MCU?

Is MCU an insurance company?

Can my family members get the same discounts or free benefits as I do?

What discounts do I get with MCU membership?

Who do I contact when I have a question about insurance?

Can my spouse or children receive coverage?

Does my coverage ever end?

Do I get a payout if I’m hospitalized?

Do I have to buy auto insurance?

Can you get GAP protection after you purchase a car?

Can I add GAP to a loan I’ve almost paid off?

Can I get GAP for a car that I lease?

How long does my GAP last?

Is Guaranteed Asset Protection considered insurance?

Guaranteed Asset Protection (GAP) s a voluntary, non-insurance product designed to waive the remaining loan balance not covered by the borrower's primary insurance carrier settlement in the event of a total loss or unrecovered theft, subject to limitations and exclusions, including but not limited to loan-to-value (LTV) maximum, delinquent payments, late charges, refundable service warranty contracts and other insurance related charges.

Do Roadside Assistance personnel respond to accidents?

Is AD&D the same as Life Insurance?

Can the amount of coverage I get change?

Purchasing Additional Coverage includes the Increasing Benefit, which means the longer you have the coverage, the value of the Additional Coverage could increase each year by 5 percent for up to a total of 50 percent over 10 years, at no added cost to you. For example, a $100,000 Additional Coverage amount could be $150,000 after 10 years of being active.

From age 18 to 69, your coverage can’t decrease for any reason. At age 70, however, the full amount of coverage you have will decrease by 50 percent. Some features may vary by state.

Do I have to buy home or condo insurance?

Unlike auto insurance, it's possible to own a home without carrying insurance in some cases. However, if you have a mortgage on your home, it's likely your lender will require you to carry a homeowner's policy. Also, condominium boards typically require owners to purchase condo insurance whether they have a mortgage or not.

Even if you don't have a mortgage, it's a wise choice to protect the value of your home and its contents with a homeowner's insurance policy. This insurance will also help protect you from liability if someone is injured on your property.

Do I have to buy renters insurance?

What happens when I call TruStage®?

When you call 1-855-483-2149 to claim your member discount, a licensed agent will answer your questions and give you friendly, helpful information — with no sales pressure.

When you're ready to get a quote, an agent will ask you some questions and walk you through your options. It's a good idea to have a copy of your current insurance policy handy to compare coverage and features. That way, it's easy to see how much you could save if you switch companies.

Does Mechanical Breakdown Protection replace car insurance?

Does Mechanical Breakdown Protection pay for repairs and maintenance?

How many times can I use my Mechanical Breakdown Protection?

Does my family get to use Mechanical Breakdown Protection?

Can I add family members to my Term Life Insurance plan?

Will I lose coverage if I change jobs or leave work?

What will my beneficiaries receive?

Do my premiums increase if I lose my job or miss a payment?

Can I add family members to my Whole Life Insurance plan?

What do my beneficiaries get out of my Whole Life Insurance?

Loans

How can I make a loan payment?

What type of documentation do I need for a Personal Loan?

To apply for a personal loan at MCU you will need a few things.

- You will need to be an existing MCU member.

- You will need to submit a loan application—online, at your local branch, or by calling us at 1-844-MCU-NYNY (1-844-628-6969).

- You will need to provide proof of identity such as: Birth certificate, certificate of citizenship, driver’s license, military ID, passport, Social Security card, or state-issued ID.

- You will need to provide employer information and may need to provide income verification, such as: pay stubs, tax returns, W-2s and 1099s, bank statements, or employer contact information.

- You may also be required to provide additional documentation, but if that time comes, we will be sure to let you know.

Do I need to be a member to apply for a loan?

What is the closing process?

How do I know if a type of loan is the right option for me?

Because everyone’s scenario is unique, please feel contact an MCU representative or a Lending Sales Specialist at 1-844-MCU-NYNY (1-844-628-6969). Our team is available to help you make an informed decision regarding which loan you should pursue.

What is the difference between a Personal Loan and Share Secured Loan?

How long does it take to get approved for a Personal Loan?

MCU Visa Credit Cards

What happens if I lose my MCU VISA® credit card?

Can I be alerted when a purchase is being made?

How many points do I earn with each purchase?

Do I need to have established credit in order to get an MCU VISA® credit card?

How do True Rewards Visa® rewards points work?

NYMCU Digital Banking

Can I access my MCU account online?

Will I need to register for NYMCU Digital Banking?

How do I access the digital banking platform if I forgot my username or password?

If you forgot your username or password, click on the “Forgot Username” or “Forgot Password” links in the login box and follow the instructions to complete the process to change your username or password. You’ll need your account number, social security number, birth date and email address to change your username. To change your password, you will need your username, social security number and email address.

If you have not logged in to digital banking in 12 months or more, your enrollment did not carry over to the new platform and you will need to register as a new user.

What browser and devices are supported?

We recommend that you use the latest version available for the browser for your desktop or laptop computer. Additionally, all iOS and Android devices are compatible with our online and mobile banking experience Your device should support the minimum requirements:

- 128-bit encryption is supported

- Cookies are supported

- JavaScript is enabled

Desktop Browsers

In order to provide a better and more secure online banking experience to our users, the new digital banking experience will work with the following browsers:

- Microsoft Edge: 2 most recent versions

- Mozilla Firefox: 2 most recent versions

- Google Chrome: 2 most recent versions

- Safari: 2 most recent versions

Microsoft Internet Explorer is not compatible with the new digital banking experience.

Mobile Browsers

Online Banking is designed to work with touch-based operating systems commonly found on tablet devices. The following tablet-based operating systems are supported:

- Chrome for Android

- Mobile Safari for iOS devices

Browser Features

The following should be enabled in your devices:128-bit encryption

- Cookies

- JavaScript

Rates & Fees

What are your fee structures?

How are APY and dividend rates determined?

What are your current interest rates?

What is the prime rate?

Retirement Accounts

What’s the difference between a variable rate and a fixed rate?

Do I get penalized for taking money out of my IRA?

Am I able to have two different IRA’s at one time?

Will my rate ever change the duration of my term?

How do I apply to open an IRA?

Is my IRA tax-deductible?

At what point is the money in my account taxed?

Can I take my money out of the account at any time?

At what age can I withdraw money from my Flexible IRA?

Can I claim my IRA contributions on my taxes?

Student Banking

How do I know if I am eligible to open an MCU2 account?

If I am under 17, do I need a parent or guardian to sign up for me?

Do I need to open all these products? Or can I pick and choose?

I am a college student, but not in New York. Am I eligible?

Youth Accounts

How do I apply to open a Coverdell ESA for my child?

What kind of documentation is needed in order to open a Youth Account for my child?

Provide one document from each section below to open a Youth Account (or activate within 15 days if account opened off-site):

Proof of Relationship:

- Valid Birth Certificate

- Social Security number

- Adoption Papers

- Proof of Guardianship

Proof of Identification (for children over 13):

- Valid School ID

- Learner's Permit

- Working Papers

- U.S. Passport

- Valid Non-Driver ID

Is there a minimum balance charge or monthly fee to maintain a Youth Account?

Who else can contribute money to my child’s Coverdell ESA?

What are the IRS requirements?

General terms for any Coverdell ESA account are outlined by the IRS. Here are the main requirements to consider:

When the account is established, the designated beneficiary must be under the age of 18 or be a special needs beneficiary.

The account must be designated as a Coverdell ESA when it is created.

The document creating and governing the account must be in writing, and it must meet certain requirements.

There are other rules too, which you can find more on the IRS website.

Can I make multiple accounts?

Yes, there's no limit to the number of accounts that can be established for a particular beneficiary. However, the total contribution to all accounts on behalf of a beneficiary in any year can't exceed $2,000.

If you’re interested in saving beyond that limit, look into Savings account options MCU offers for short-term or long-term goals.

Previous Menu

Previous Menu