- Home

- Meet the Team

- Log In

- Contact

- Careers

- Search

- Search Results

- Branches & ATMs

- Rates

- Log In

- About MCU

- Join MCU

- Personal Banking

- Lending

- Credit Cards

- Lending Services

- Insurance

- Member Resources

- MCU Financials

- Forms and Disclosures

- Privacy Policy

- Automated Telephone Banking

- Order New Checks

- Security & Fraud Alerts

- Privacy Notice

- Schedule an Appointment

Make Smart Investment Decisions with a Loan from MCU.

Deciding to invest in a property can be an exciting step toward building a secure future, but it can be difficult to know where to start. Our members get access to a straightforward application process and expert Lending Sales Specialists to help them make the right moves toward an exceptional financial future.

Easy Online Application & Management

You can apply for an Investment Property Loan using MCU’s easy online application. Making payments online is easy too, with our suite of flexible, automated payment tools.

Future-Centric Decision Making

Investing in real estate is a great way to build long-term financial health, and we’re ready to help make it happen by providing you with the right loan with terms that make sense for your future.

Top-Notch Member

Support

At MCU, we’ve always got your back. Our team of Lending Sales Specialists is there to help do the heavy lifting, answer pressing questions, and guide you in the right direction through every step of the process.

We’re Ready to Help You Get Past Any Homebuying Hurdles.

Whether you’ve just started browsing for real estate or have already picked out an investment property, MCU is ready to help you bring your goals to life.

Our team of Lending Sales Specialists is excited to help you find the right lending option for your unique needs, and ready to answer any questions that pop up along the way.

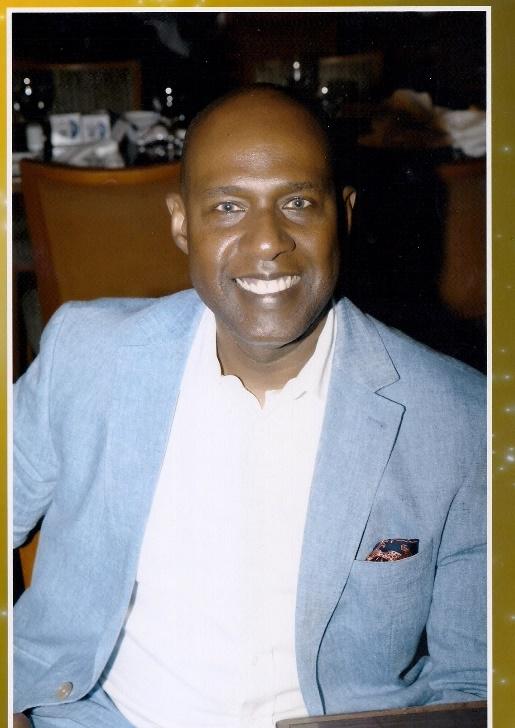

Sean Remy

Lending Sales Assistant

Davibel Rivera

Lending Sales Assistant

NMLS ID: 1815505

Hailee Reilly

Mortgage Sales Assistant

NMLS ID: 2237363

Shalin Ramirez

Mortgage Sales Assistant

NMLS ID: 2636618

Explore Additional MCU Lending Options.

We work hard to ensure that our community heroes get the financial support they deserve. Whether you're buying a home, a vehicle, or something else, MCU is here to help you along the way.

No Matter Where You Are in Life, We’re Right There with You.

At MCU, we believe that a credit union should be a lifelong source of financial education and support—from planning for college to saving for retirement and everything in between.

That’s why we have specialized recommendations for products and services designed to help you meet your goals (both short-term and down the road), based on your changing needs and priorities.

Make the Most of Your MCU Membership.

Membership in our community is about more than just banking. As an MCU member, you can access valuable information and resources to help you plan and reach your financial goals.

Mobile Banking Tips for Staying Safe in the Digital World

A Guide to Digital Con Artists: The Academy Award Goes To... Your Local Scammer

Don't Get Butchered: NYC's Guide to Spotting "Pig Butchering" Scams

FAQs

Get Answers to Our Most Frequently Asked Questions.

What percent down do I need for an Investment Property Loan?

What is the limit I can borrow?

Your borrowing limit will be determined based on a mix of factors, such as your yearly income, the term length of your mortgage, and the mortgage interest rate.

Use our mortgage calculator to get an estimate of the investment mortgage you may be able to qualify for.

Previous Menu

Previous Menu

.jpg?width=524&height=499&name=looking-to-finance-investment-property_image-isolated-(1).jpg)