- Home

- Meet the Team

- Log In

- Contact

- Careers

- Search

- Search Results

- Branches & ATMs

- Rates

- Log In

- About MCU

- Join MCU

- Personal Banking

- Lending

- Credit Cards

- Lending Services

- Insurance

- Member Resources

- MCU Financials

- Forms and Disclosures

- Privacy Policy

- Automated Telephone Banking

- Order New Checks

- Security & Fraud Alerts

- Privacy Notice

- Schedule an Appointment

DIRECT DEPOSIT

Why Wait to Get Paid?!

You have 2 easy ways to deposit your paycheck, pension, Social Security, or any other recurring income—automatically!

In addition to being simple and convenient, you will also get your payment 2 days in advance with direct deposit or payroll deduction.

Features & Benefits

- No more waiting in line to make a deposit

- Make scheduled deposits directly into your savings

- Reduce the risk of lost or stolen checks

- Get your money 2 days earlier

- Quick and Easy enrollment

HOW TO ENROLL

DIRECT DEPOSIT EMPLOYMENT PAYCHECKS:

Contact your employer’s payroll department to find out if they offer direct deposit.

Please complete this form and submit it to your employer’s payroll department. If your payroll or benefits provider prefers to use their own form, you can use this as a reference. Provide your employer with our routing number (also known as the ABA Number): 226078036, and your checking account number. You can find your checking account number within Digital Banking under Account Details on your monthly statement, next to each account, and at the bottom of your checkbook.

Get paid 2 days early!

Or Search for Your Employer:

For Direct Deposit, please search for your employer.

For Payroll Deduction:

To enroll in payroll deduction, please call us at (212) 693-4900 or fill out our Payroll Deduction Authorization Form and email to payroll@nymcu.org.

Bedford Center Nursing & Rehab (The Allure Group)

Brookdale Medical Center

Cooperative Home Care Associates

Crown Heights Nursing & Rehab (The Allure Group)

CUNY Employees

Department of Corrections

Department of Education

Department of Sanitation

FDNY

Hamilton Park Nursing & Rehab (The Allure Group)

Harlem Center Nursing & Rehab (The Allure Group)

Health & Hospital

King David Nursing & Rehab (The Allure Group)

Human Resource Administration (HRA)

Linden Center Nursing & Rehab (The Allure Group)

MTA

New York Police Department (NYPD)

NYCHA

NYC Parks Department

NY Presbyterian Hospital

NY State Employees

Services for the Underserved

Silvercrest Nursing Home

Not able to find your employer?

No worries. Just take the following information to your employer to get the process started.

Routing Number: MCU’s Routing Number (also known as the ABA Number) is 226078036

Account Number: Your Account Number can be located:

- On the bottom of your check book (if you request one)

- Within Digital banking account # is listed under Account Details of each product.

- On your statements next to each account.

For Direct Deposit from Federal Agencies:

If you receive payments from Social Security, the VA, or other agencies, please fill out this form. Refer to the instructions on the form for the mailing address, as well as alternate methods for signing up online or by phone. For Federal Benefit Payments, our routing number is 226078036.

FAQs

Get Answers to Our Most Frequently Asked Questions.

What’s the difference between "available balance" and "total balance"?

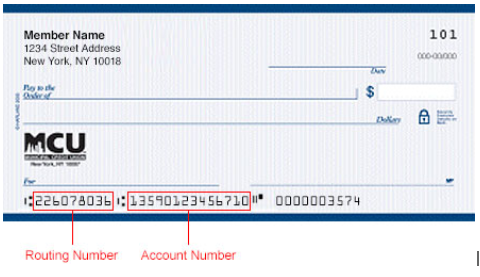

Where can I find my Routing and Account Number?

Both are listed on the bottom of your MCU personal checks. Please see the diagram below for reference:

DISCLOSURE:

* Overdraft Protection is a loan (subject to credit approval), the terms of which are set forth in the Overdraft Protection Line of Credit Agreement.

Previous Menu

Previous Menu