- Home

- Meet the Team

- Log In

- Contact

- Careers

- Search

- Search Results

- Branches & ATMs

- Rates

- Log In

- About MCU

- Join MCU

- Personal Banking

- Lending

- Credit Cards

- Lending Services

- Insurance

- Member Resources

- MCU Financials

- Forms and Disclosures

- Privacy Policy

- Automated Telephone Banking

- Order New Checks

- Security & Fraud Alerts

- Privacy Notice

- Schedule an Appointment

Direct Deposit & Payroll Deduction

Get Your Money Early.

Enjoy two safe and easy ways to deposit your paycheck, pension, Social Security, or any other recurring income—automatically!

How to Get Started

For Direct Deposit, please search for your employer.

For Payroll Deduction:

To enroll in payroll deduction, please call us at (212) 693-4900 or fill out our PAYROLL DEDUCTION AUTHORIZATION FORM and email to payroll@nymcu.org.

Bedford Center Nursing & Rehab (The Allure Group)

Brookdale Medical Center

Cooperative Home Care Associates

Crown Heights Nursing & Rehab (The Allure Group)

CUNY Employees

Department of Corrections

Department of Education

Department of Sanitation

FDNY

Hamilton Park Nursing & Rehab (The Allure Group)

Harlem Center Nursing & Rehab (The Allure Group)

Health & Hospital

King David Nursing & Rehab (The Allure Group)

Human Resource Administration (HRA)

Linden Center Nursing & Rehab (The Allure Group)

MTA

New York Police Department (NYPD)

NYCHA

NYC Parks Department

NY Presbyterian Hospital

NY State Employees

Services for the Underserved

Silvercrest Nursing Home

Not able to find your employer?

No worries. Just take the following information to your employer to get the process started.

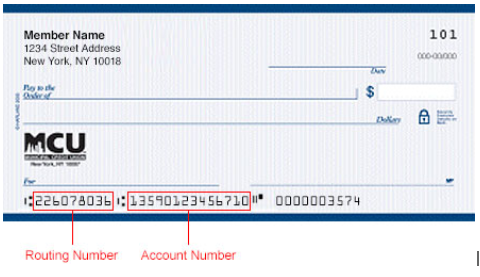

Routing Number: MCU’s Routing Number (also known as the ABA Number) is 226078036

Account Number: Your Account Number can be located:

- On the bottom of your check book (if you request one)

- Within Digital banking account # is listed under Account Details of each product.

- On your statements next to each account.

Save Time and Energy by Automating Deposits.

No more waiting in line at the bank each payday—MCU makes it easy to grow your savings and manage your money effortlessly with Automatic Transfer and Direct Deposit.

Never Wait in Line to Make a Deposit.

The days of walking a paycheck to the bank and waiting in line to deposit it are over. As soon as your payment is available, it’ll go directly into your Share Account, Everyday Hero Checking account, or Basic Share Draft account.

Send Deposits Straight to Your Savings.

Make regular deposits directly into the savings buckets of your choosing, so you can meet your financial goals minus the hassle of manual money management.

What is Direct Deposit?

Direct Deposit is a convenient and secure method that enables employees to have their entire paycheck deposited directly into their bank account. By eliminating the need for physical checks or cash, this electronic transfer ensures a seamless and efficient process for receiving earnings. Non-city employees will also have the flexibility to choose between depositing the full amount or only a partial portion of their earnings.

What is Payroll Deduction?

Payroll Deduction is used for city employees when they do not want to have their entire check deposited into MCU. Unlike Direct Deposit, it allows employees to specify a specific amount to be deducted from their paycheck. This flexible option lets them allocate funds for savings, investments, loan repayments, or other purposes. They can easily adjust the deduction amount, providing them with enhanced financial planning abilities.

Make the Most of Your MCU Membership.

Membership in our community is about more than just banking. As an MCU member, you can access valuable information and resources to help you plan and reach your financial goals.

What Are Share Certificates?

Avoid Tax Scams

The Smart Borrower’s Guide

FAQs

Get Answers to Our Most Frequently Asked Questions.

What’s the difference between "available balance" and "total balance"?

Where can I find my Routing and Account Number?

Both are listed on the bottom of your MCU personal checks. Please see the diagram below for reference:

DISCLOSURE:

* Overdraft Protection is a loan (subject to credit approval), the terms of which are set forth in the Overdraft Protection Line of Credit Agreement.

Previous Menu

Previous Menu